The days your bins will be collected is changing. Read our FAQ's about your new collections.

2024/25 Council Tax consultation

Date published: 6th February 2024

This consultation is now closed

North Norfolk District Council is consulting its residents for the 2024/25 budget, seeking views on whether the authority should increase its proportion of the 2024/25 Council Tax bills.

Each year, the Council sets its budget and the Council Tax collected is one source of income that funds the functions and services it provides to residents in North Norfolk.

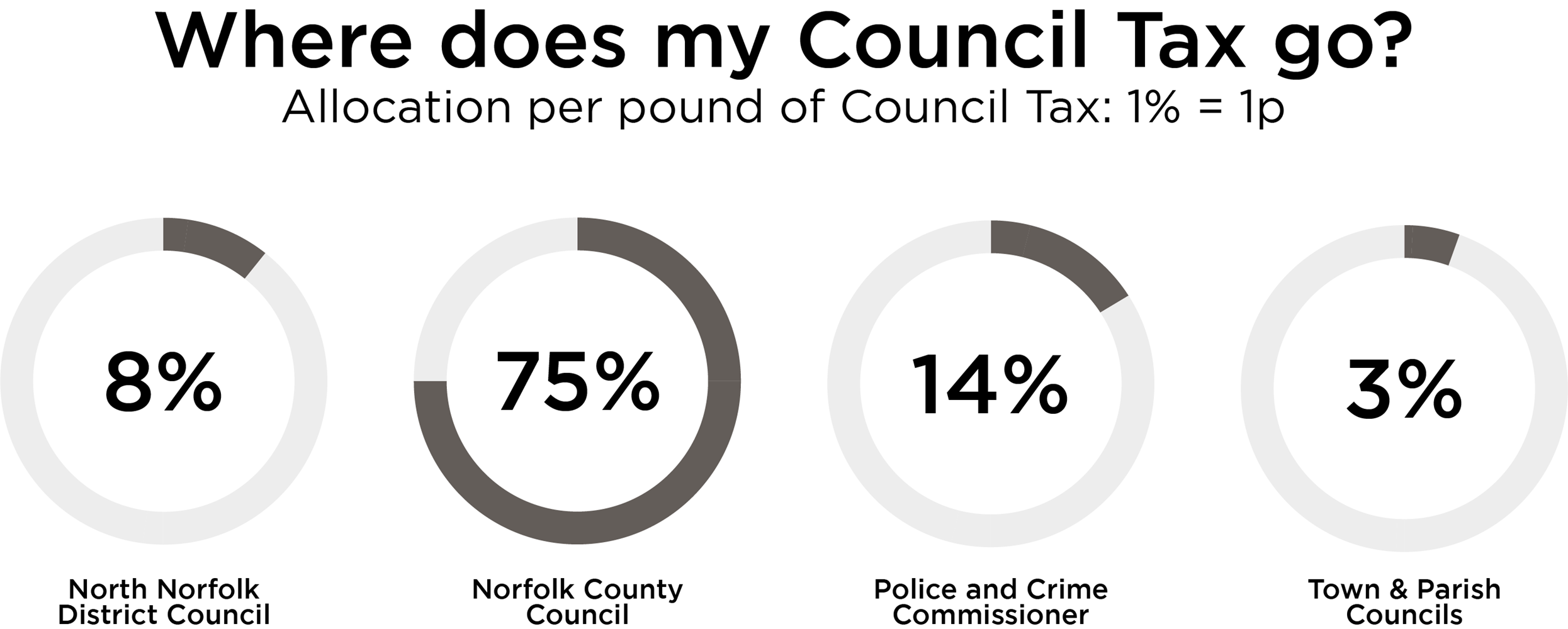

The Council collects Council Tax, but retains just 8p of every £1 of Council Tax, with 92p going to Norfolk County Council, the Police & Crime Commissioner and Town & Parish Councils.

Monies received from Central Government for local authorities have been given on the assumption that Councils will be raising Council Tax by the maximum amount available to them, with many authorities across the UK already proposing to raise their precepts.

The Council is facing budgetary pressures, having to address an additional £700,000 and rising temporary accommodation costs as housing need and cost of living pressures continue to increase.

The late introduction of legislation, which would allow the Council to introduce a 100% Council Tax premium on second homes, means £550,000 of expected income during 2024/25 can now not be included in the budget, and must be found elsewhere.

The Council has a legal responsibility to balance the budget for each financial year.

A cost saving exercise has been undertaken, identifying nearly £1m in savings which can be made, with a further £250,000 of savings still to be identified throughout the financial year. Having undergone this financial exercise, the Council is now consulting on whether to raise the Council tax precept to bridge the gap in the budget.

If the Council opts to freeze Council Tax, additional savings of £205,000 must be found elsewhere, representing a significant real-terms cut as inflationary pressures on existing contracts and services including the Council’s outsourced waste and recycling and leisure contracts are significant. Any freeze of the District Council’s element of the Council Tax bill is therefore likely to involve difficult decisions about potential service reductions.

For the average band D property, this increase would represent an increase of £4.95 a year, (10p a week).

The £4.95 per year figure is based on a Band D property and will be scaled between bands – for properties in Bands A-D, which represents over 75 percent of properties in North Norfolk, the Council Tax increase would 10p or less per week. This is still one of the lowest Council Tax precepts in the country.

This consultation is now closed

Last updated: 19th February 2024